Describe the Ethical Issues of Using the Petty-cash Fund.

Following a standard operating procedure will ensure that the fund runs smoothly. The custodian lets the cash balance decline to 10 before replenishing.

This is an asset on the balance sheet of many small businesses.

. Petty cash is a store of money that is easily accessible ie in the form of cash that companies and other organizations keep for expenditure on miscellaneous and small items. However failing to hold employees accountable for petty cash may encourage theft or inappropriate use of company resources. The cashier issues a replenishment check for 280 The entry is.

The petty cash fund is established as a pre-designated fixed. Petty cash also known as cash on hand refers to small amounts of cash kept on hand in a business. By using business credit cards in place of petty cash business owners add a layer of protection to their funds.

Keeping large amounts of. This dictates how much cash should be replenished when receipts pile up and cash is low. Learn the risks of using petty cash and about alternative options.

When petty cash funds are replenished the total of the replenishment form cannot exceed the full balance of the fund. Petty cash is a store of money kept in an office to be used on various employee expenditures typically small items and logs need to be maintained. Cash count and verification of funds must be performed periodically at least quarterly by someone other than the custodian.

To make change for customers or patients. The basic process of setting up a petty cash system is. Prezi is simple.

As this petty cash fund is established the account titled Petty Cash is created. At all times the cash and the receipts signed for withdrawals should equal the total of the fund in the general ledger. Since the petty cash vouchers total only 9260 the amounts do not agree and the fund is short 130 9390 needed 9260 in.

Company A has a petty cash fund for which it approved 100. Accordingly the entry looks like this. The entry made is as below.

A petty cash system is a set of policies procedures controls and forms that a company uses to dispense cash for various miscellaneous needs such as office supplies and services. When it comes to lost or stolen cash theres no easy way to recover those funds. The whole process surrounding petty cash is characterized by.

The petty cash custodian is charged with distributing the cash and. Like for a taxicab. Petty cash is the most liquid asset of an organization and is easily misappropriated if business processes and controls are not established.

Learn about our editorial policies. At least once per year departments must re-examine whether the petty cash account is still required to meet the departments business needs or if. Require that employees maintain a running petty cash log for every transaction including receipts.

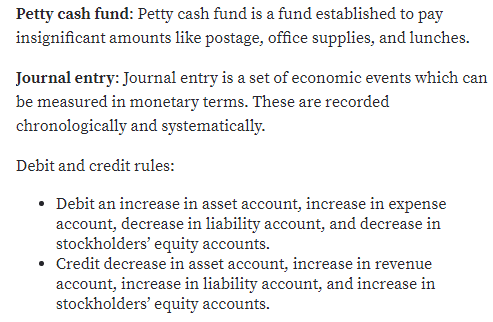

Petty cash funds are not to be used as an operating fund eg petty cash funds should not be used to pay invoices for goods. Petty cash isnt usually a significant expense for your business. The journal entry to establish the petty cash fund would be as follows.

Reducing the use of petty cash can help small business owners minimize risk. Ideally the custodian assigned to the petty cash fund can manage its day-to-day use with little supervision. Decide upon the locations where petty cash funds will be installed.

Verification of cash balances must be performed in the presence of the custodian. Restoring the fund to 100 requires a check for 9390 100 fund amount petty cash remaining 610. Its amazing how much cash is stolen each year from petty cash funds.

Generally petty cash funds for orgs local units should be set up in amounts not to exceed 500. Unfortunately the more petty cash transactions you have. Before a petty cash account is set up the organization determines the maximum amount to be held in petty cash.

Petty cash is a small amount of cash that companies keep on hand in a locked drawer or box to pay for minor business expenses. Keeping cash around in a business always comes with risk. In this case the cash account which includes checking accounts is decreased while the funds are moved to the petty.

Updated on July 16 2019. The initial petty cash journal entry is a debit to the petty cash account and a credit to the cash account. Consider a few of the risks and drawbacks of using petty cash.

Petty cash is used for small incidental expenses where it is not convenient to use a check. Keeping the ledger or record of petty cash disbursements with the fund further increases the risk of misappropriation. However in larger businesses each department or building may have its own petty cash fund.

Alternatively the cashier could simply count out the cash for the petty cash fund if there are enough bills and coins on the premises. It is a discretionary cash fund for payments where bank transfers or writing a check British. Its essential to manage and track petty cash use.

That cash is supposed to be petty dealt with in small amounts. To maintain internal controls managers can use a petty cash receipt which tracks the use of the cash and requires a signature from the manager. Thus the cashier issues a check worth 90 for replenishment.

You Write Zoom ArrangeUsing these simple means you can express many things - with great impactHere are some basic examples such as. Without proper controls the businesss petty cash account becomes vulnerable to theft by employees and its hard for you to know who took the cash. The term petty comes from petite or smallThere are two reasons to keep petty cash.

A petty cashier might be assigned to issue the check to fund the petty cash drawer and make the appropriate accounting entries. The fact that petty cash is so difficult to track means theres a high risk of errors or discrepancies in the process and reimbursement of petty cash is particularly vulnerable to miscounting and mistakes. Particulars Debit Credit.

Only one person should have access to the petty cash fund. That said using petty cash may require less oversight than other options. The cash should be in a locked box and kept in a locked drawer or filing cabinet.

Petty cash and change funds are subject to periodic cash counts. Because a petty cash fund circumvents the usual expenditure reporting procedures within an organization the risk for misappropriation of the petty cash funds is increased. A petty cash fund is a type of imprest account which means that it contains a fixed amount of cash that is replaced as it is spent in order to maintain a set balance.

In small companies theres usually one petty cash fund. To reimburse employees for items they have bought. Evaluate need for petty cash account annually.

Cheque would not be the best or most sensible. Results must be documented and reported to Cash Merchant Services.

Fiscal Petty Cash Vs P Cards Goals History Of Petty Cash Understand Issues And Concerns Of Petty Cash Future Of Petty Cash Accounts History Ppt Download

Fiscal Petty Cash Vs P Cards Goals History Of Petty Cash Understand Issues And Concerns Of Petty Cash Future Of Petty Cash Accounts History Ppt Download

No comments for "Describe the Ethical Issues of Using the Petty-cash Fund."

Post a Comment